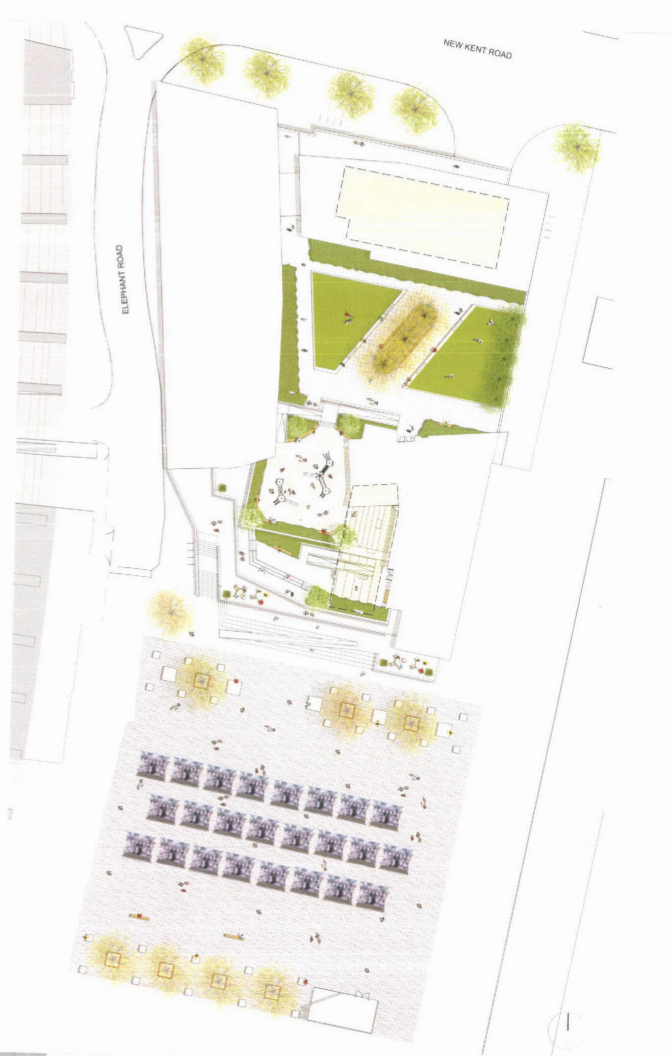

Delancey’s Tribeca Square (Elephant Rd Development)

The latest Elephant tower has begun to loom over the rubble of the Heygate estate. Delancey DV4’s ‘Tribeca Square’ is a suitably absurd name (Tribeca is a neighbourhood in Manhattan) for an absurd development - 270 student studios & 370 private residences for market rent with no affordable housing. Rents are expected to be set at around £375pw for a 1-bed and £500pw for a 2-bed.

Tribeca’s prefabricated claddingTribeca Square is being built entirely using an offsite prefabricated construction technique pioneered by Laing (the company that built the Heygate). Even the bathrooms are prefabricated in Dubai.

Tribeca’s prefabricated claddingTribeca Square is being built entirely using an offsite prefabricated construction technique pioneered by Laing (the company that built the Heygate). Even the bathrooms are prefabricated in Dubai.

The Tribeca Square site was public land until 1987, it then housed an industrial estate which was demolished when the land was sold in 2006 to Delancey shell company Eadon Estates for £8.5m.

Delancey DV4 is a multimillion pound real-estate developer registered in the British Virgin Islands, which has been accussed of ‘aggressive tax avoidance. It is funded by George Soros and managed by Tory donor Jamie Ritblatt.

Planning gain giveaway

Eadon Estates very quickly secured planning approval after first acquiring the site in 2006. Eadon Estates then sold the site to Eadon Limited in 2007 for £18.8m and in December 2008 Eadon Limited went back to Southwark’s planning committee asking for variations in the site’s planning permission.

This included adding 61 private residential units to the revised scheme, reducing the affordable housing to zero and making no payment in-lieu. A viability assessment was submitted to show that the development was not viable without these changes.

The planning officer’s report recommended approval of the variations, adding for good measure that the council’s in-house valuers had confirmed that “the negative effect of on-site social rented housing on the end values of the private units could in this case render the scheme financially unviable” . The report explained that the design implications of providing a “separate entrance for the affordable units would reduce the overall retail provision within the scheme which wouldn’t support the planning objective of creating a strong and continuous retail frontage at the base of the towers.” The report also claimed that “it is not possible to show that the value from the additional 61 private residential units produces any additional value”

Southwark’s loss…

For failing to provide any on-site affordable housing, Delancey should have paid £52.7m under Southwark’s tariff for in-lieu affordable housing payments1. It offered nothing and Southwark finally settled for a consolatory payment of just £1m2.

Delancey’s gain…

We show here the confidential viability assessment Delancey submitted for this application. It states that the completed residential flats would sell for an average of just £525 per square foot. This is well below the £829 per square foot3 average sales price achieved by the neighbouring Strata Tower development. If we take this as the measure and multiply the difference by Tribeca’s total residential square footage (247,079 sqft) we get a staggering £75 million undervaluation.

We show here the confidential viability assessment Delancey submitted for this application. It states that the completed residential flats would sell for an average of just £525 per square foot. This is well below the £829 per square foot3 average sales price achieved by the neighbouring Strata Tower development. If we take this as the measure and multiply the difference by Tribeca’s total residential square footage (247,079 sqft) we get a staggering £75 million undervaluation.

A different comparison would be against the current sales price of flats on the neighbouring Heygate redevelopment, the cheapest of which is a 1-bed flat currently on sale for £415,000 giving £967 per sqft; nearly double the Delancey estimate. Multiplying the Heygate/Tribeca difference by the total Tribeca floorspace gives an undervaluation of £109m.

The huge discrepancy between estimated and actual end sales values, might be explained to some extent by rising property values in the (sometimes prolonged) period between planning approval and completion. But even time-adjusted comparisons show that the original estimates for Tribeca Square were extremely pessimistic. The result is that Southwark has lost a great deal of affordable housing and Delancey have made a great deal of profit.

In 2011 Eadon Estates sold the site for £40m to DV4 Eadon Ltd (another Delancey shell company registered in the British Virgin Islands).

In 2011 Eadon Estates sold the site for £40m to DV4 Eadon Ltd (another Delancey shell company registered in the British Virgin Islands).

In 2013 former deputy council leader Kim Humphries resurfaced at the Elephant working for Delancey as an independent development consultant.

Para 6.29 of the planning statement says affordable housing not viable because of market square.

-

Southwark’s in-lieu affordable housing tariff is £100,000 per habitable room x 527 habitable rooms (35% of Tribeca Square total) = £52.7m↩

-

See page 2 (Affordable Housing Commuted Sum) of the s106 legal agreement.↩

-

See Strata Tower achieved end sales values (avg. £829 psqft) on pg. 4 of this Winter 2011/2012 Colliers International market data report.↩