The planning documents for the Aylesbury estate outline masterplan have been removed from Southwark council’s planning portal. The documents for the first development site under the masterplan have also been removed. The applications were lodged on 25th September and the documents uploaded about a month later. On inquiry, Southwark said that the applications had been “uploaded in error, they are currently invalid and not open to consultation.” It also said that “as soon as the relevant documentation has been received .. and been made valid they will be posted on the website”. It is not clear whether the applications have been withdrawn and now need to be re-submitted. Our previous blog on the Aylesbury applications pointed out - amongst other things - that 934 social rented homes are to be lost if the development goes ahead as planned.

The planning documents for the Aylesbury estate outline masterplan have been removed from Southwark council’s planning portal. The documents for the first development site under the masterplan have also been removed. The applications were lodged on 25th September and the documents uploaded about a month later. On inquiry, Southwark said that the applications had been “uploaded in error, they are currently invalid and not open to consultation.” It also said that “as soon as the relevant documentation has been received .. and been made valid they will be posted on the website”. It is not clear whether the applications have been withdrawn and now need to be re-submitted. Our previous blog on the Aylesbury applications pointed out - amongst other things - that 934 social rented homes are to be lost if the development goes ahead as planned.

Meanwhile, Aylesbury leaseholders are fighting to get a fair deal from the council and its development partners Notting Hill Housing & Barratt Homes. A leaseholders’ deputation will be submitting 5 demands to the council’s Cabinet meeting on Tuesday. Amongst their very sensible requirements is one that any council officer who values their homes is actually qualified to do so, as it turns out this is not always the case: a leaseholder’s complaint to the recognised professional body (RICS) could not be dealt with because the officers concerned were not RICS qualified or registered. The leaseholders have requested instead that valuations are conducted by the District Valuer Service.

At the same meeting, Southwark will also be receiving a deputation from the Southwark Group of Tenants Organisation, who also have some suggestions, this time about improving the six pledges Southwark has made for conducting its consultation on building 11,000 new council homes. Southwark should adopt these improved pledges, it will be a step in the right direction, but it is also clear that the Council already has definite ideas about how these new homes will be provided, including estate regeneration and estate infill.

Head in the clouds

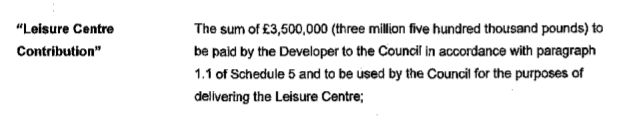

Southwark’s Head of Regeneration Councillor Mark Williams, obviously got a bit giddy last week at the topping out ceremony of Lend Lease’s One the Elephant tower (or maybe Lend Lease plied him with too much champagne). He tweeted from the rooftop ceremony about the wonderful view as well as the “new homes, jobs and leisure centre for local residents”. A second tweet claimed that the development was providing £12.5m towards the new leisure centre (costing £25m), but as we can see below from the legal agreement the figure is actually only £3.5m. Lend Lease got out of providing any on-site affordable housing or making any payment in-lieu for the development through the magic of viability assessments and as we showed in a previous blog Southwark should have netted £33.2m under its in-lieu affordable housing payment tariff.

Southwark’s Head of Regeneration Councillor Mark Williams, obviously got a bit giddy last week at the topping out ceremony of Lend Lease’s One the Elephant tower (or maybe Lend Lease plied him with too much champagne). He tweeted from the rooftop ceremony about the wonderful view as well as the “new homes, jobs and leisure centre for local residents”. A second tweet claimed that the development was providing £12.5m towards the new leisure centre (costing £25m), but as we can see below from the legal agreement the figure is actually only £3.5m. Lend Lease got out of providing any on-site affordable housing or making any payment in-lieu for the development through the magic of viability assessments and as we showed in a previous blog Southwark should have netted £33.2m under its in-lieu affordable housing payment tariff.

Southwark also sold the One the Elephant land to Lend Lease for the price of £6.5m (£4.6m per acre), which is a bargain considering that the gross development value of the tower will be upwards of £230m1. Our interactive map also shows how this compares to other land sales at the Elephant:

While Cllr Williams’ head was in the clouds, Labour shadow minister for planning, Roberta Blackman-Woods, was keeping her feet firmly on the ground when she visited the Heygate site last week, tweeting that Lend Lease’s scheme was “very interesting”. Ms Woods might also be interested in the risks local authorities run when they enter into partnership agreements with global property giants like Lend Lease, as illustrated by this story from its other major development site in Sydney, Australia, where city authorities stand to lose millions after losing a bitter court battle with Lend Lease over a profit-share agreement.

While Cllr Williams’ head was in the clouds, Labour shadow minister for planning, Roberta Blackman-Woods, was keeping her feet firmly on the ground when she visited the Heygate site last week, tweeting that Lend Lease’s scheme was “very interesting”. Ms Woods might also be interested in the risks local authorities run when they enter into partnership agreements with global property giants like Lend Lease, as illustrated by this story from its other major development site in Sydney, Australia, where city authorities stand to lose millions after losing a bitter court battle with Lend Lease over a profit-share agreement.

Footnotes

-

This is based on an expected average sales value of £815 per sq foot, which was the average sales price achieved by the Strata tower. One the Elephant comprises 269,000sq ft of residential floorspace in total; the total expected residential sales is therefore £219m (269k X £815), plus 13,000 sq ft of retail in One the Elephant’s pavilion with an approximate value of £10m.↩