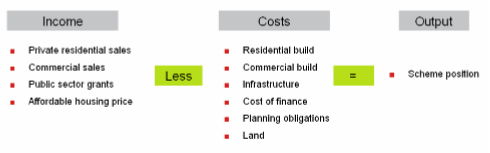

The redevelopment of the Heygate estate is essentially a land sale to a private developer. The Council get a capital receipt for the land and the developer provides some infrastructure and community benefits. There is an assumed profit to the developer of 20% of the total costs plus the profit left over when all the new buildings have been sold. The community benefits that were originally supposed to be provided in return for the Heygate redevelopment were to include:

- A new school

- A new library

- A leisure centre

- Affordable housing

- A MUSCo energy utility

- Upgrades to local public transport

Plans for the school and library have now been dropped, and the leisure centre is being developed in a separate land-sale development.

The Heygate site was also supposed to provide 50% affordable housing and a MUSCo - (a biomass energy generation plant), which was going to provide ‘green’ heat and power for the whole E&C and Walworth area including the proposed development at the Aylesbury estate. This was in line with the ‘zero carbon’ objectives for the scheme, which proposed that the new developments would all be carbon neutral and enabled it to be selected as one of Bill Clinton’s Climate Positive Initiatives.

Now these too have been dropped from the scheme: the outline planning application contains no minimum guarantee of any affordable housing, and the biomass Combined Heat & Power network has been dropped in favour of a standard gas-fired boiler, which will only supply the new homes on the Heygate footprint.

Lend Lease acknowledges that these changes are a significant deviation from the original plan and also a breach of planning policy, but justifies this in its planning application by claiming that these are constraints imposed by the financial viability of the scheme:

Sustainability “A number of other alternative renewable energy sources are considered in the strategy. However, they do not secure the quantum of CO2 savings that are anticipated through biomethane and impact on the commercial viability.“

Affordable Housing “The outline planning application commits to the Site delivering as much affordable housing as is financially viable.“

It would therefore appear that financial viability is the key variable in the whole scheme and the main determinant of whether it will provide any community infrastructure at all.

It would therefore appear that financial viability is the key variable in the whole scheme and the main determinant of whether it will provide any community infrastructure at all.

Members of the local community have raised concerns about the proposed loss of community benefits from the scheme, and have asked the Council to share information about the scheme’s viability. However, the Council has refused to make public any details concerning viability claiming that it is “likely to prejudice the commercial and economic interests of both the council and Lend Lease.”

All that has been released concerning viability so far is a series of heavily redacted minutes from Council meetings with Lend Lease and its planning consultants ‘DP9’.

The Government’s Homes & Communities Agency has acknowledged these viability issues and has recently published guidelines for local authorities in responding to the economic downturn:

“The HCA strongly encourages stakeholders to employ a transparent approach to considering viability. Transparent viability appraisals have the potential to remove the mistrust and suspicion that has often characterised negotiations around the viability of planning obligations sought by adopted planning policy.”

The 35percent campaign urges Southwark to release information relating to viability testing, so that we can better understand why the scheme’s original community benefits can no longer be provided.

We think this is especially important since Lend Lease’s recent conviction for serious fraud in connection with a similar regeneration scheme in New York.

If you are a Southwark resident and wish to add your voice to this demand, you can do so by lodging an objection by following the instructions on the link here. The planning application reference number is 12/AP/1092.